What we know of as IFTA was born in 1983 when a group of government and industry representatives set out to simplify the payment and documentation of fuel taxes. The permits were issued as stickers that were then arranged on a special license plate called a Bingo Plate. The permit could only be issued at designated Ports of Entry.

Prior to IFTA’s creation, each truck required a tax permit for each state where it operated.

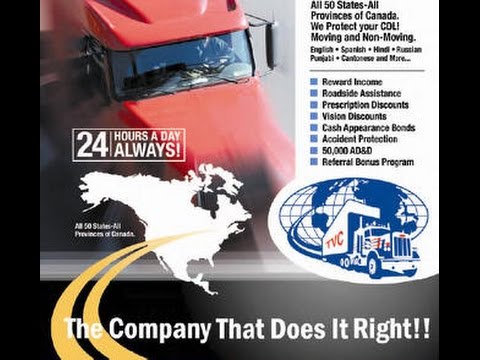

TVC TRUCKING REGISTRATION

Initiatives like the Multi-State Reciprocal Agreement of 1962 and the International Registration Plan of 1973 helped lay the groundwork for what would become IFTA. IFTA fuel tax past and presentĪs early as just after World War I, jurisdictions levied taxes on the growing number of vehicles on the road. Complying with IFTA regulations is important for the longevity and sustainability of all commercial carriers. Under IFTA, licensed carriers can submit one quarterly tax return to their base jurisdiction concerning fuel usage, as opposed to individual returns for each state visited. It exists to ensure public works and infrastructure projects continue to happen today. IFTA was a natural byproduct of the growing transportation industry. The transportation industry has been classically funded by motor fuel taxes. IFTA, or the International Fuel Tax Agreement, was created to streamline the collection and distribution of fuel taxes for carriers who operate in multiple jurisdictions. A fleet management platform can help you create fast, accurate reports.All vehicles used/designed to transport people or property must apply for an IFTA license if they meet certain conditions.A thorough understanding of IFTA requirements can help sharpen awareness of total business activity.

0 kommentar(er)

0 kommentar(er)